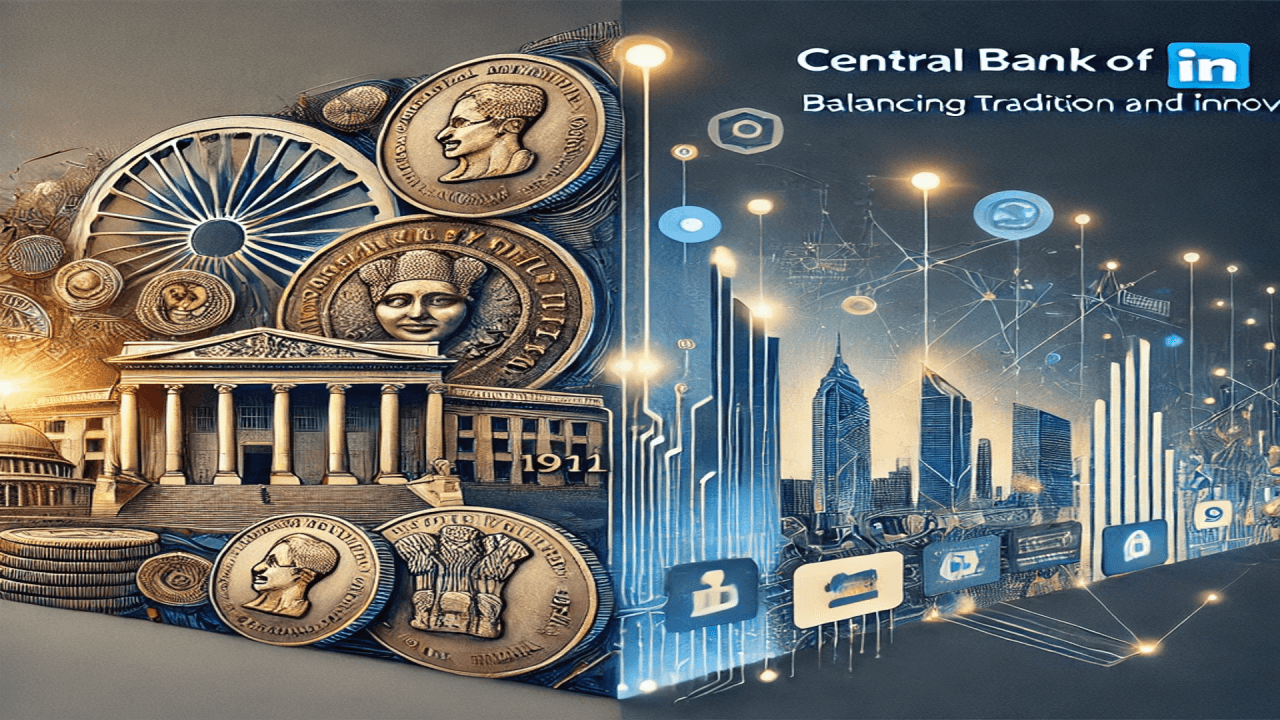

The Central Bank of India is one of the oldest and most respected public sector banks in India. Founded in 1911, it holds the distinction of being the first Indian commercial bank wholly owned and managed by Indians. With over a century of service, the bank has played a crucial role in the development of India’s financial sector and in providing accessible banking to millions of citizens.

Founding and History

The Central Bank of India was established on 21st December 1911 by Sir Sorabji Pochkhanawala, a visionary banker and nationalist. At a time when most banks in India were either foreign or British-owned, this bank emerged as a symbol of Indian financial self-reliance. It was called “Central” not because it was a central government bank, but because it aimed to become a central financial hub for Indians.

Nationalization and Growth

In 1969, the Government of India nationalized 14 major commercial banks, including the Central Bank of India. This marked a significant turning point in the bank’s journey, giving it a stronger public service mandate. Since then, the bank has expanded its footprint across India, especially in rural and semi-urban areas, to support inclusive growth.

Today, the Central Bank of India has:

- Over 4,500+ branches

- Around 3,600+ ATMs

- A wide range of digital banking services

- A strong presence in all Indian states and union territories

Services and Products

Central Bank of India offers a full spectrum of banking services including:

1. Retail Banking

- Savings and Current Accounts

- Fixed and Recurring Deposits

- Personal, Home, and Vehicle Loans

- Debit and Credit Cards

2. Corporate and MSME Banking

- Business Loans

- Working Capital Financing

- Export-Import Banking

- Project Finance

3. Agriculture Banking

- Kisan Credit Card (KCC)

- Crop and Tractor Loans

- Agri-Infrastructure Funding

4. Digital Services

- Cent Mobile App

- Internet Banking

- UPI and QR-based Payments

- e-Tax Payment and e-Filing

Social Responsibility and Financial Inclusion

Central Bank of India has always aligned with the government’s initiatives like Jan Dhan Yojana, Mudra Loans, Stand-Up India, and PMAY (Pradhan Mantri Awas Yojana). It actively promotes financial literacy, SHGs (Self-Help Groups), and rural banking to support unbanked and underserved populations.

Recent Developments and Digital Push

In recent years, the bank has adopted a forward-looking digital approach:

- Enhanced cybersecurity

- Integration with BHIM and UPI systems

- Launch of Cent-Token app for secure online banking

- Upgraded core banking infrastructure for real-time transactions

It’s also implementing AI-powered systems and fintech partnerships to enhance customer experience and competitiveness.

Key Achievements

- First Indian commercial bank to be completely Indian-owned.

- Played a major role in the Swadeshi Movement by promoting Indian enterprise.

- Partner bank for several government subsidy and welfare programs.

- Consistently recognized for rural credit and agriculture finance.

Challenges and Future Outlook

Like many public sector banks, Central Bank of India has faced challenges such as:

- Rising non-performing assets (NPAs)

- Competition from private and digital-only banks

However, with ongoing reforms, recapitalization support from the government, and a push for digital modernization, the bank is well-positioned to grow stronger and continue serving India’s economy.

Conclusion

The Central Bank of India is more than just a financial institution; it is a symbol of India’s banking independence and commitment to inclusive growth. With its deep-rooted values and vision for the future, the bank continues to empower individuals, support industries, and contribute to national development.

Watch

Watch

CASUAL WEAR

CASUAL WEAR

[…] Central Bank of India is one of the oldest and most trusted public sector banks in the country, offering a wide range of […]

[…] to the dynamic financial ecosystem of the country. For investors and stock market analysts, Central Bank of India’s share price serves as a vital indicator of the bank’s performance, the health of the banking […]

[…] Porn and Its Regulation in India– The internet has created an unprecedented space for people to access, share, and produce […]