Introduction

SWIFT Code:- In today’s global economy, money often needs to move across borders quickly and securely. Whether you are sending funds to family abroad, paying international suppliers, or receiving payments from overseas clients, ensuring your money reaches the correct destination is crucial. This is where SWIFT codes come into play.

A SWIFT code, also known as a BIC (Bank Identifier Code), is an internationally recognized code that uniquely identifies banks and financial institutions around the world. It acts as a digital address for your bank, helping ensure that international transactions are routed accurately and efficiently.

Without a SWIFT code, international wire transfers can be delayed, misrouted, or even rejected, causing unnecessary stress and extra costs. In this article, we will explore why SWIFT codes are so important, how they work, and how they benefit both individuals and businesses engaged in cross-border transactions.

What is a SWIFT Code?

A SWIFT code is an internationally recognized alphanumeric code that identifies specific banks and financial institutions during cross-border transactions. Also known as a BIC (Bank Identifier Code), it serves as a unique identifier for each bank, ensuring that international payments are routed accurately and efficiently.

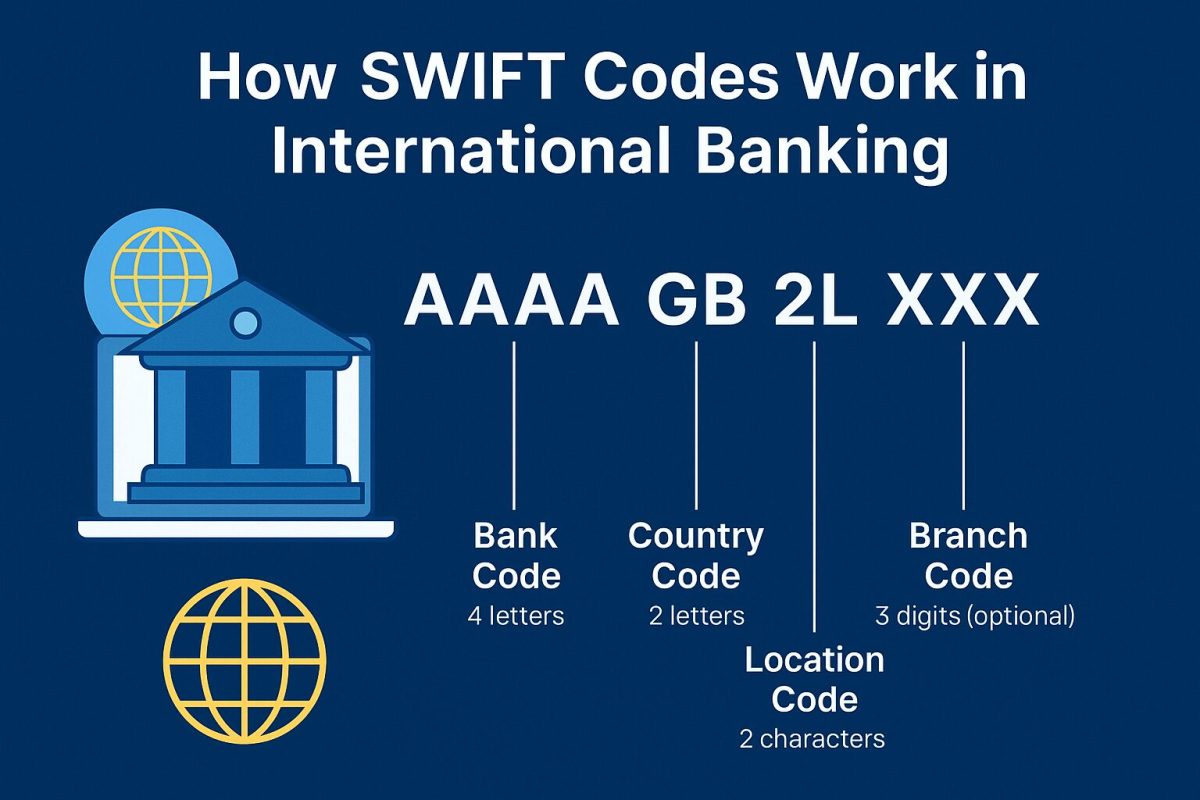

Structure of a SWIFT Code

A typical SWIFT code consists of 8 to 11 characters, each segment providing specific information:

- Bank Code (4 letters): Identifies the bank or financial institution. For example, “HDFC” for HDFC Bank.

- Country Code (2 letters): Specifies the country where the bank is located. For instance, “IN” represents India.

- Location Code (2 letters or digits): Indicates the location of the bank’s head office or main branch.

- Branch Code (3 letters or digits, optional): Identifies a specific branch of the bank. If omitted, it usually refers to the bank’s main branch.

Example: HDFCINBBXXX

- HDFC = Bank code

- IN = Country code (India)

- BB = Location code

- XXX = Main branch

Purpose of a SWIFT Code

The primary purpose of a SWIFT code is to ensure accuracy in international money transfers. By uniquely identifying the recipient’s bank and branch, SWIFT codes prevent errors and delays, allowing funds to reach the intended account securely.

Who Uses SWIFT Codes?

- Individuals sending or receiving money internationally.

- Businesses paying suppliers or receiving payments across borders.

- Banks and financial institutions facilitating secure cross-border transfers.

SWIFT codes act as a global standard in banking, making international transactions faster, safer, and more reliable.

How SWIFT Codes Work in International Transactions

When transferring money across borders, accuracy, speed, and security are critical. SWIFT codes play a vital role in ensuring that international transactions are executed correctly. They act as a universal addressing system for banks worldwide, helping to route funds to the correct financial institution and branch.

Step-by-Step Process of a SWIFT Transaction

- Initiation by the Sender

The sender provides their bank with the recipient’s bank details, including the SWIFT code, account number, and sometimes additional information like the branch address. This ensures the bank knows exactly where the funds should be sent. - Routing Through the SWIFT Network

The sender’s bank communicates securely through the SWIFT network, which connects over 11,000 financial institutions globally. The SWIFT code ensures that the message reaches the correct bank and branch without ambiguity. - Processing by Intermediary Banks (if required)

Some transactions may pass through one or more intermediary banks before reaching the recipient’s bank. The SWIFT code ensures each bank along the route can process and forward the funds accurately. - Completion and Confirmation

Once the recipient’s bank receives the payment, it credits the recipient’s account. Both the sender and the recipient often receive confirmation messages, ensuring transparency and trust.

Key Benefits of Using SWIFT Codes

- Accuracy: Funds are directed to the exact bank and branch.

- Security: SWIFT messages are encrypted, minimizing fraud risk.

- Speed: Reduces delays compared to non-standardized transfer methods.

- Reliability: Ensures smooth cross-border transactions even in complex banking networks.

Example Scenario

Suppose a business in the United States wants to pay a supplier in India. By providing the recipient bank’s SWIFT code, the sender ensures the payment goes directly to the supplier’s bank account without mistakes, delays, or the need for manual intervention.

Importance of SWIFT Codes

In the realm of international banking, SWIFT codes play a crucial role in ensuring that cross-border transactions are accurate, secure, and efficient. Whether you are an individual sending money abroad or a business managing international payments, understanding the importance of SWIFT codes is essential.

1. Ensures Accurate Transactions

A SWIFT code acts as a unique identifier for banks worldwide. By providing this code during an international transfer, you ensure that funds reach the correct bank and branch, minimizing the risk of errors that could delay or misroute the payment.

2. Speeds Up International Transfers

SWIFT codes standardize the process of transferring money across countries. Banks can quickly identify the recipient institution, allowing for faster processing compared to manual methods or unstandardized systems.

3. Enhances Security

SWIFT transactions are conducted over a highly secure network used by thousands of financial institutions globally. The encryption and standardized procedures reduce the risk of fraud and unauthorized access.

4. Reduces Transaction Costs

By ensuring funds are routed correctly the first time, SWIFT codes minimize the need for intermediary corrections or failed transfers, helping both individuals and businesses save on extra fees.

5. Mandatory for International Wire Transfers

Most banks require a SWIFT code for sending or receiving international wire transfers. Without it, your transaction could be delayed, rejected, or returned, causing inconvenience and potential financial losses.

6. Facilitates Global Business

For businesses involved in import/export, payroll, or cross-border e-commerce, SWIFT codes are indispensable. They allow companies to pay international suppliers, receive funds from clients, and manage finances efficiently.

7. Provides Transparency and Tracking

SWIFT codes allow both the sender and recipient to track the transaction through confirmation messages and receipts, ensuring transparency and accountability in international financial dealings.

When Do You Need a SWIFT Code?

A SWIFT code is essential whenever you are involved in international financial transactions. Knowing when to use it ensures that your money reaches the intended bank safely and efficiently.

1. Personal Transactions

- Sending Money Abroad: If you are transferring funds to family or friends overseas, the SWIFT code ensures the money reaches the correct bank and branch.

- Receiving Remittances: When receiving funds from another country, the sender will need your bank’s SWIFT code to process the transfer accurately.

2. Business Transactions

- Paying International Suppliers: Businesses importing goods or services must use SWIFT codes to ensure payments reach the supplier’s bank account correctly.

- Receiving Payments from Clients Abroad: Companies exporting goods or providing services internationally require SWIFT codes to receive funds efficiently.

- Managing Cross-Border Payroll: Multinational companies paying employees in different countries rely on SWIFT codes to ensure timely salary payments.

3. Online Banking and E-Commerce

- International E-Commerce Payments: Businesses selling products globally may need SWIFT codes to receive payments from international customers.

- Cross-Border Subscription Services: Companies offering subscription services worldwide require SWIFT codes for smooth recurring payments.

4. Special Banking Situations

- Foreign Investment Transfers: If you are investing in foreign stocks, mutual funds, or real estate, your bank may require a SWIFT code to transfer funds.

- Loan or Mortgage Payments Abroad: When repaying loans or mortgages in another country, a SWIFT code ensures the money reaches the correct financial institution.

Using a SWIFT code in these scenarios prevents delays, errors, and unnecessary costs, making international banking safer and more efficient.

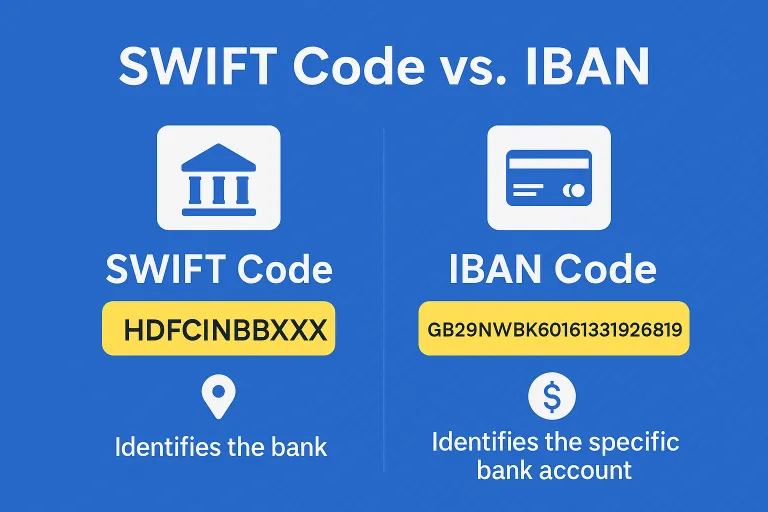

Difference Between SWIFT Code and IBAN

While both are used for international transactions, they serve different purposes:

| Feature | SWIFT Code | IBAN |

|---|---|---|

| Purpose | Identifies the bank | Identifies the recipient’s account |

| Format | 8-11 characters | Varies by country, up to 34 characters |

| Requirement | Mandatory for international transfers | Required in many European countries |

| Function | Ensures funds reach the correct bank | Ensures funds reach the correct account |

Both are often used together for precise international money transfers.

How to Find Your Bank’s SWIFT Code

Finding the correct SWIFT code is essential for smooth international transactions. Using the wrong code can result in delays, additional fees, or even misrouted payments. Here are reliable ways to locate your bank’s SWIFT code:

1. Check the Bank’s Official Website

Most banks provide their SWIFT codes on their official websites, often under sections like “International Transfers” or “Contact Us.” This is usually the most accurate and up-to-date source.

2. Review Bank Statements

Some banks include the SWIFT code on account statements or transaction slips, particularly for accounts used for international transactions.

3. Contact Customer Service

Calling your bank’s customer service or visiting a branch is a reliable way to confirm the SWIFT code. Bank staff can provide the correct code for both the main branch and specific branches if needed.

4. Use the SWIFT Directory

The official SWIFT website provides a searchable directory of SWIFT codes for financial institutions worldwide. This tool allows you to verify the correct code for your bank and branch.

5. Online Banking Platforms

Many banks display SWIFT codes within their online banking or mobile banking apps, often under international transfer options.

Tips for Accuracy

- Always double-check the code before initiating an international transfer.

- Include the branch code if your bank requires it to ensure funds reach the correct branch.

- Verify the SWIFT code with the recipient if sending money to someone else’s account.

Using these methods ensures that your international transactions are processed correctly, quickly, and securely.

Common Mistakes to Avoid

Using a SWIFT code incorrectly can lead to delays, additional fees, or failed international transactions. Understanding common mistakes helps ensure your money reaches the intended recipient safely and efficiently.

1. Entering the Wrong SWIFT Code

Providing an incorrect SWIFT code may cause your payment to be sent to the wrong bank or rejected. Always double-check the code before initiating a transfer.

2. Forgetting the Branch Code

Some banks require the branch code as part of the SWIFT code, especially for large or precise transactions. Omitting it may delay processing or redirect the payment.

3. Confusing SWIFT Codes with Routing Numbers

SWIFT codes are for international transactions, while routing numbers are used for domestic transfers (e.g., within the United States). Using the wrong system can result in failed transfers.

4. Using an Outdated Code

Banks occasionally update SWIFT codes due to mergers, rebranding, or system changes. Always verify the latest code from the bank’s official source before sending money.

5. Incorrect Account Details

Even with the correct SWIFT code, providing wrong account numbers, recipient names, or currency details can cause delays or transaction failure. Accuracy in all information is crucial.

6. Ignoring Fees and Transfer Times

Different banks and intermediaries may charge fees for processing SWIFT transfers. Ignoring these details can lead to unexpected costs or delayed fund availability.

7. Not Confirming International Transfer Requirements

Some countries or banks require additional information, such as purpose codes, tax IDs, or intermediary banks. Failing to provide these can prevent the transaction from being completed.

By avoiding these common mistakes, you can ensure that your international transactions are smooth, secure, and timely, maximizing the benefits of using SWIFT codes.

Benefits of Using SWIFT Codes

SWIFT codes are a cornerstone of international banking, providing security, speed, and reliability for cross-border transactions. Understanding their benefits helps individuals and businesses appreciate why these codes are essential.

1. Global Acceptance

SWIFT codes are used by over 11,000 financial institutions in more than 200 countries, making them the universal standard for international money transfers.

2. Accuracy in Transactions

By uniquely identifying each bank and branch, SWIFT codes minimize the risk of errors, ensuring that funds reach the correct account without delays or misrouting.

3. Enhanced Security

Transactions using SWIFT codes are processed over a highly secure network. This encryption reduces the risk of fraud, unauthorized access, or interception during international transfers.

4. Faster Processing

SWIFT codes standardize the process for banks worldwide, allowing international transfers to be executed quickly compared to non-standardized or manual methods.

5. Cost-Efficiency

Correctly routed transactions reduce the need for corrections, failed transfers, or intermediary bank charges, saving both time and money for individuals and businesses.

6. Facilitates Business Operations

For businesses engaged in global trade, SWIFT codes simplify international payments, supplier settlements, payroll transfers, and client invoicing, ensuring smooth financial operations.

7. Transparency and Tracking

SWIFT transactions can be tracked, providing both the sender and recipient with confirmations. This transparency builds trust and accountability in financial dealings.

8. Mandatory for International Wire Transfers

Most banks require SWIFT codes to process cross-border payments, making them indispensable for international financial activities.

Conclusion

In an increasingly interconnected world, international financial transactions are a routine part of personal and business banking. SWIFT codes play a pivotal role in ensuring that these cross-border payments are accurate, secure, and efficient.

By uniquely identifying banks and branches worldwide, SWIFT codes minimize errors, reduce delays, and provide a standardized system that banks, businesses, and individuals can rely on. Whether you are sending money to family abroad, paying international suppliers, or receiving payments from overseas clients, using the correct SWIFT code ensures that your funds reach the intended destination without complications.

Beyond accuracy, SWIFT codes enhance security, facilitate faster processing, and reduce unnecessary costs associated with failed or delayed transactions. For businesses engaged in global trade or individuals making international transfers, these codes are indispensable for smooth financial operations.

In summary, understanding and using SWIFT codes correctly is not just a technical requirement—it is a critical aspect of modern international banking. Proper use of SWIFT codes ensures peace of mind, financial efficiency, and the safe movement of money across borders.

FAQ: SWIFT Codes and International Transactions

General Questions About SWIFT Codes

Q1. What is a SWIFT code?

A1. A SWIFT code, also known as a BIC (Bank Identifier Code), uniquely identifies a bank or financial institution during international transactions.

Q2. Why is a SWIFT code important?

A2. It ensures that funds reach the correct bank and branch, reducing errors and delays in international money transfers.

Q3. How many characters does a SWIFT code have?

A3. Typically 8 to 11 characters.

Q4. What is the difference between SWIFT and BIC codes?

A4. There is no difference; BIC (Bank Identifier Code) is another name for a SWIFT code.

Q5. Is a SWIFT code required for international transfers?

A5. Yes, most banks require a SWIFT code for cross-border transactions.

Q6. Can I use a SWIFT code for domestic transfers?

A6. No, SWIFT codes are primarily for international transactions.

Q7. How do SWIFT codes work?

A7. They act as a unique address, routing payments securely from the sender’s bank to the recipient’s bank.

Q8. Are SWIFT codes the same for every branch of a bank?

A8. Main branches often share the code, but some banks use unique codes for specific branches.

Q9. Can a wrong SWIFT code affect my transfer?

A9. Yes, it can delay the transaction or cause it to be rejected.

Q10. Who manages the SWIFT network?

A10. The Society for Worldwide Interbank Financial Telecommunication (SWIFT).

Finding SWIFT Codes

Q11. How do I find my bank’s SWIFT code?

A11. Check the bank’s website, bank statements, contact customer service, or use the SWIFT directory online.

Q12. Can I find a SWIFT code in online banking?

A12. Yes, many banks display it under international transfer options.

Q13. Are SWIFT codes the same for all countries?

A13. No, each bank in each country has its unique code.

Q14. How do I verify a SWIFT code?

A14. Use the bank’s official website or the official SWIFT directory.

Q15. What if my bank doesn’t provide a SWIFT code?

A15. Contact customer service; they will provide the correct code for international transfers.

Q16. Do all banks have SWIFT codes?

A16. Most banks that process international transactions have SWIFT codes.

Q17. Can I use a branch code with a SWIFT code?

A17. Yes, some banks require the branch code to route funds precisely.

Q18. How do I know if my SWIFT code is valid?

A18. Cross-check it with the bank’s official sources or the SWIFT directory.

Q19. Are SWIFT codes free to use?

A19. Yes, but banks may charge fees for the international transaction itself.

Q20. Can I send money without a SWIFT code?

A20. Usually not; most international wire transfers require it.

International Transactions

Q21. How fast are SWIFT transfers?

A21. Typically 1-5 business days, depending on banks and countries involved.

Q22. Are SWIFT transfers secure?

A22. Yes, SWIFT operates over an encrypted, secure network.

Q23. Do SWIFT transfers cost money?

A23. Banks may charge fees, which vary by institution and intermediary banks.

Q24. Can I track a SWIFT transfer?

A24. Yes, banks provide confirmation and tracking details for SWIFT payments.

Q25. Can SWIFT codes prevent fraud?

A25. They reduce the risk by ensuring the payment goes to the correct bank.

Q26. Can multiple currencies be sent via SWIFT?

A26. Yes, SWIFT transfers support various currencies worldwide.

Q27. Can SWIFT codes be used for business payments?

A27. Yes, businesses use SWIFT codes to pay suppliers and receive international funds.

Q28. What happens if the SWIFT network is down?

A28. Transactions may be delayed until the network is operational.

Q29. Do SWIFT codes guarantee immediate transfer?

A29. No, processing time depends on banks and intermediary institutions.

Q30. Are SWIFT transfers reversible?

A30. Generally, once processed, they cannot be reversed, emphasizing accuracy in using SWIFT codes.

Differences and Comparisons

Q31. What is the difference between SWIFT and IBAN?

A31. SWIFT identifies the bank, while IBAN identifies the recipient’s account for international transfers.

Q32. Do I need both SWIFT code and IBAN?

A32. Often yes, especially for transfers to European countries.

Q33. Can I use a SWIFT code without an IBAN?

A33. Depends on the country; some require both for accuracy.

Q34. How is SWIFT different from routing numbers?

A34. SWIFT codes are for international transfers; routing numbers are used domestically (e.g., USA).

Q35. Can I use the same SWIFT code for multiple accounts?

A35. Yes, if the accounts are at the same bank and branch.

Q36. Does SWIFT guarantee exchange rates?

A36. No, banks determine the currency conversion rate separately.

Q37. Are SWIFT codes case-sensitive?

A37. No, they are not case-sensitive.

Q38. Can SWIFT codes expire?

A38. Banks may update codes, so always confirm before a transaction.

Q39. Are SWIFT codes only for banks?

A39. Mostly, but some financial institutions like brokers may have SWIFT codes.

Q40. Can a SWIFT code be used for multiple branches?

A40. Main branch codes may apply, but specific branches can have unique codes.

Practical Use Cases

Q41. When sending money abroad, what details are required?

A41. Recipient’s name, account number, SWIFT code, bank name, and sometimes branch address.

Q42. Can I use SWIFT for online purchases?

A42. Yes, for international e-commerce payments requiring wire transfers.

Q43. Do all countries use SWIFT codes?

A43. Most countries with international banking use SWIFT, though some local systems exist.

Q44. Can I receive money via SWIFT without a bank account?

A44. No, you need a bank account to receive SWIFT transfers.

Q45. Can SWIFT codes be used for large transactions?

A45. Yes, they are suitable for both personal and large business transactions.

Q46. Are SWIFT codes used for cryptocurrency exchanges?

A46. No, SWIFT is for traditional banking; crypto exchanges use other systems.

Q47. Can I send money to multiple recipients using one SWIFT code?

A47. Each transfer must include individual recipient account details, even if the bank is the same.

Q48. How do SWIFT codes affect remittances?

A48. They ensure remittances reach the intended recipient quickly and securely.

Q49. Are SWIFT codes linked to bank fees?

A49. Indirectly, as accurate routing avoids extra charges from failed or corrected transfers.

Q50. Where can I learn more about SWIFT codes?

A50. Check your bank, the official SWIFT website, or financial guides covering international banking.

Watch

Watch

CASUAL WEAR

CASUAL WEAR